Think the 100 Million plus ordinary Filipinos only have debts to pay? Well that’s not the case according to the World Bank.

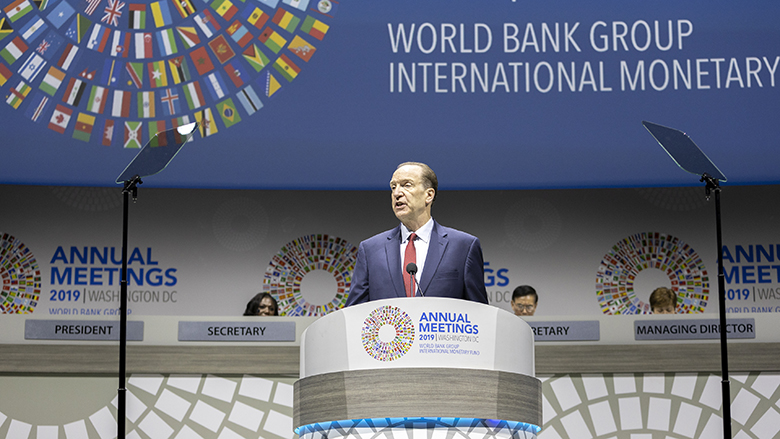

In an interview with Reuters, World Bank President David Malpass said on Tuesday that the world’s poorest countries now owe $62 billion in annual debt service to official bilateral creditors, an increase of 35% over the past year, warning that the increased burden is increasing the risk of defaults.

Malpass revealed that two thirds of this debt burden is now owed to China, providing some details of the development lender’s annual debt statistics report due next week.

“I’m worried about a disorderly default process where there’s not a system to really address” debts for poorer countries, Malpass said.

He was also concerned about a buildup of debt in advanced economies such as the United States, because this is drawing more capital away from developing countries “And so as the interest rates go up, the debt service goes up for the advanced economies, and that requires a big amount of capital from the world.” the World Bank President said.

Malpass is scheduled to join a meeting in China next week with heads of other international institutions and Chinese authorities to discuss the country’s approach to debt relief for poorer countries, COVID-19 policies, property sector turmoil and other economic issues.

“China’s one of the big creditors, so…it’s very important that China engage on this issue and think about where it sees the world going and be responsive to work with what needs to be done to achieve sustainability for the countries.” Malpass said.

Aside from the World Bank president, International Monetary Fund chief Kristalina Georgieva will also participate in the meeting. The said meeting will focus heavily on debt treatments. Among the participants will be officials from China Development Bank and the Export-Import Bank of China, two of the country’s major bilateral lenders.

In a separate interview with Reuters, Georgieva told reporters that changes to the G20 Common Framework on debt restructuring were needed to speed up debt treatments, freeze debt service payments once a country requested help, and open the process to middle-income countries like Sri Lanka.

“We are concerned that there is a risk for confidence in debt resolution to be eroded at a time when the level of debt is very high,” Georgieva said.

The IMF official said that they don’t see at this point a risk of a systemic debt crisis; adding that countries in debt distress were not large enough to trigger a crisis that would threaten financial stability.

More Stories

Sorsogon secured trade and investment opportunities

‘Our hearts are in Bethlehem,’ Pope Francis says on Christmas Eve

BIGGS gainfully employed differently abled persons